SunTrust doesn't disclose where its services are available on its website. If you're interested in its mortgages, contact a representative to see if it services your area.Does SunTrust offer refinancing? SunTrust offers interest rate reduction refinancing for veterans and cash-out refinancing.Does SunTrust sell its loans? The SunTrust site doesn't mention whether or not it sells its loans.What mortgage payment options does SunTrust offer?

SunTrust offers a few payment options, including one-time payments, SurePay recurring payments and biweekly mortgage plans. You can easily pay online if you have a SunTrust bank account. SunTrust also makes cash-out refinancing available to doctors. Cash-out refinancing is an excellent tool to pay for business startup costs and to pay down student debt.

That's because the homeowner gets to use the equity they've built up in their home to get liquid cash. Make sure to keep your credit score and payment history in good shape to take advantage of this solution. 5 Exchange many closing cost obligations for a higher rate on your loan. You still may be required to pay interim interest, mortgage insurance, escrows and/or discount points at closing. Certain fees may be collected in advance and reimbursed only upon successful closing of loan.

Only available in fixed-rate purchase or refinance loans of $75,000 or more, and may not be available on all loan types, including certain Federal, State or local government programs. Options for lowering your rate may also be available through the payment of discount points at closing. 1 Exchange many closing cost obligations for a higher rate on your loan.

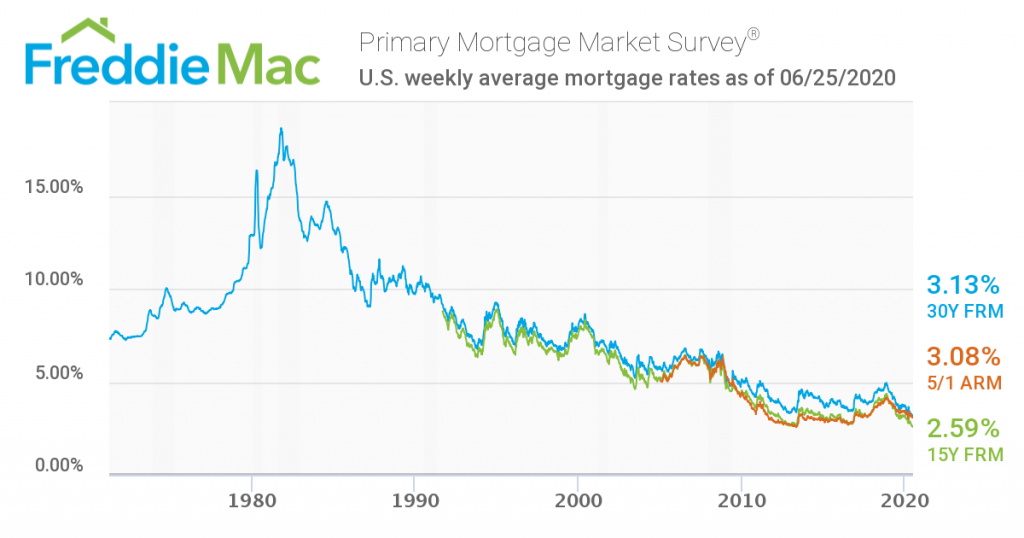

Borrowers who are looking to minimize their monthly mortgage payments may be interested in the ARM programs. These loans carry lower mortgage rates than loans that have a fixed rate and payment for their entire life. But, they also carry the risk that they will adjust in the future. These rates can change every day and are based on a few assumptions.

For instance, the 30-year fixed purchase rate quote assumes your credit score is higher than 740 and your down payment is at least 20%. With this option, you would still have only one mortgage, but the loan application process could take longer and there may be additional fees and closing costs. Bank of America is a big bank lender that offers mortgage and refinance loan products, along with full banking services. There are more than 5,000 branch locations in the U.S., in addition to its online mortgage options, which includes the Bank of America Digital Mortgage Experience. This provides customers with online applications, electronic signatures for documents and online rate locks.

Borrowers also can connect with a lending specialist online. SunTrust is an American banking company that offers multiple types of mortgage and refinancing options. It was named one of the 2019 Best Mortgage Lenders by NerdWallet for its refinancing and loan options with low and no down payments. It employs local loan officers and provides online applications so you can easily and conveniently get started on the mortgage borrowing process. The minimum credit score required by Truist varies depending on the type of loan, but a representative didn't provide specifics. It helps to know minimum credit score requirements by loan type, though.

Conventional loans typically require a score of at least 620, while your credit score can be as low as 500 or 580 with an FHA loan, depending on your down payment. Both the VA and USDA don't set credit requirements, though the lender might have a minimum. Of course, with any loan program, having a higher credit score can help you qualify for the best mortgage rates. As always, it's important to consider a variety of lenders before making a decision for refinancing. Weigh the terms of your current mortgage against new offers from lenders.

It's important to also consider the closing costs or ancillary fees that are associated with refinancing. It's always wise to use a mortgage calculator to see how much a SunTrust refinance will save – or cost – you over the life of your loan. SunTrust offers a variety of products for personal and business banking and a home equity line of credit . With low interest rates and the option to convert part of your balance to a fixed rate, SunTrust's HELOC is a good option for borrowers looking for flexible and fast funding. You can see current sample mortgage rates on the SunTrust website. To get a SunTrust rate quote that's customized to your location, credit score and other factors, you'll have to start the online application process or speak with a loan officer.

Contrary to home equity lines of credit, home equity loans provide a one-time lump sum amount at a fixed interest rate. The maximum loan amount you're allowed to take depends on the value of your property and your credit history. Banks, credit unions and online lenders all offer home equity loans.

The bank has recently merged with BB&T Bank to form Truist, which should be fully integrated in 2022, making it the sixth-largest bank in the US. SunTrust is a bank with a full range of online services, as well as in-store offerings in select locations nationwide. SunTrust provides multiple mortgage types, refinancing and other loan options. You can apply online for its standard and unconventional mortgage products. Mortgage rates can fluctuate every day and even by the hour, and every lender has its own way of setting rates for customers. So it's important to research mortgage lenders and get multiple rate quotes to find a good deal.

You'll be able to compare closing costs and figure out how even a small difference in the interest rate can help you save hundreds or thousands of dollars over the life of the loan. Truist also gives homebuyers an option between fixed- and adjustable-rate mortgages. With a fixed-rate mortgage, your mortgage rate never changes.

This could be a good option if you find a low rate and you prefer predictable payments. An ARM offers a fixed rate only for a certain amount of time. Then, based on market conditions, the rate may go up or down at specified intervals for the rest of the loan term. So with a 5/6 ARM, for instance, the rate is fixed for the first five years then adjusts every six months. Truist's ARMs are subject to rate caps per adjustment as well as life of loan.

The ARM Alternative program is a hybrid between a fixed rate and an ARM loan. It lets borrowers take out a fixed rate loan but pay a set fee to get lower payments for the first few years, simulating the lower payments of an ARM. The benefit of the ARM Alternative is that it gives low mortgage payments without the risk of significant interest rate increases in the future.

The fixed SunTrust mortgage rates offers homeowners the comfort of making the same payment every month. A fixed rate mortgage is a great choice for the homeowner who enjoys consistency in his or her mortgage payment schedule. A SunTrust fixed rate mortgage will never change over the life of a loan, which can make budgeting easier for many homeowners. If you work with SunTrust, you'll notice there is a wide variety of fixed and adjustable rate mortgages to consider.

Of course, there are still reasons to refinance that are more closely tied to interest rates. You may have improved your credit score over the years since you purchased your home and want to negotiate a better rate. Or maybe you have an adjustable-rate mortgage, where rates can change over the years, but you would like to change to the certainty of a fixed rate.

Whatever your reason, you'll want to work with a lender to crunch the numbers and determine if refinancing makes sense for your current situation. While HELOCs feature variable rates, you have the option to convert a portion or the total amount of your balance to a fixed rate during the initial draw period, which is 10 years. During that time, minimum monthly payments are either 1% or 2% of the balance, but qualifying borrowers may have the option to make interest-only payments. Regions Bank offers fixed-rate home equity loans with no closing costs starting at 3.25% APR or 3.0% APR for borrowers with good credit who enroll in automatic payments. Loan amounts range from $10,000 to $250,000 with 7, 10, 15, or 20-year repayment terms.

It also allows customers who have applied for a loan to follow along with the approval process and upload supporting documents. In addition, the customer can invite real estate agents into the process to monitor progress. With that being said the origination fee charged with SunTrust Mortgage Rates is simply too high for me to recommended with a favorable review. There are so many better offers out there if you invest a little time comparing refinance mortgage rates and fees.

Outline your Assets, including all cash, investment and retirement accounts you'll use to cover your down payment and closing costs. Securely link your bank account to avoid uploading statements later, or press Skip. To determine an average figure for each closing cost, we collected home loan estimates from the four largest banks in the US. Our scenario assumes a loan at the median US home price of $198,000, with a down payment of 10% and a credit score of 740. Other assumptions for property tax and escrow requirements were plugged into the estimate of prepaid costs, which are explained below. If you're comparing HELOCs, be sure to check out Bank of America Mortgage.

Its HELOC has no application fee, no closing costs, no annual fee, and no fee to access cash. Bank of America is also a great choice for low-income borrowers. It offers two different non-repayable grant programs to help qualified buyers get into homes. But if you can work around those drawbacks, Truist is a great option for most borrowers.

It offers all the major mortgage programs, including conventional and government-backed loans, construction loans, and jumbo loans. VA interest rate reduction refinance loan helps homeowners refinance their VA-backed home loans to make their monthly payments more affordable. Applicants may get a lower interest rate or switch from an adjustable rate to a fixed rate. You can check mortgage rate quotes and find information about the homebuying process on both the SunTrust and BB&T websites. When you start an online mortgage application with either brand, you'll be directed to the Truist Mortgage Origination platform where you'll finish the process.

Here's what to know about Truist's mortgages before applying. Truist Bank became the seventh-largest commercial bank in the U.S. after SunTrust Bank and BB&T Corp. merged in 2019. Truist is now based in Charlotte, North Carolina, and is in the process of moving every product under one retail line. As a full-service bank, customers can find consumer banking services, mortgages, home equity products, credit cards, investment products, and several types of loans. While SunTrust mortgage rates are extremely competitive on all of their lending products, they also have unique savings opportunities.

Borrowers who want to get out of debt more quickly can opt to make a payment every other week instead of once a month. Making 26 bi-weekly payments instead of 12 monthly mortgage payments lets borrowers pay off their mortgages much more quickly. In fact, a 30-year loan can pay off in around 23 years using this strategy.

Imagine being done with paying a mortgage seven years sooner. For some families it could spell the difference between being able to afford a child's college tuition or having to resort to costly student loans. Additionally, SunTrust Mortgage works with borrowers seeking financing for mortgages that are larger than Fannie Mae's conventional loan limits, known as jumbo loans.

Home equity lines of credit are available as well, but home equity loans are not. Rates and program information are deemed reliable but not guaranteed. Rates on this page are based on the purchase of a single-family, single-unit, detached, primary residence located in Richmond, VA . Rates also assume a 30 day lock for purchase and 90 day lock for refinance, and are subject to change without prior written notice. All rates are subject to length of lock, pricing adjustments for credit score, loan-to-value, property location and additional factors based on loan program. While PenFed wasn't included in JD's Primary Mortgage satisfaction study for 2021, it's known to offer competitive rates.

According to the CFPB, the financial institution received a total of 67 complaints against mortgages in the last three years, and only 13 were related to home equity lines of credit. As the nation's second-largest federal credit union, PenFed's CFPB complaint ratio was low compared to other industry giants. U.S. Bank offers home equity loans and HELOCs, both without closing costs. Home equity loan rates start at 3.80% APR for both 10 and 15-year term repayment periods, while HELOC rates begin at 3.45% APR and go up to 8.60% APR. Bank of America offers lower-than-average mortgage rates and the convenience of applying in-person or online. Their Affordable Loan Solution mortgage requires a low down payment of just 3% and no private mortgage insurance, which can save budget-minded borrowers hundreds of dollars per month.

Home Insight combines a home affordability analysis, a monthly payment estimator that accounts for insurance and taxes and the ability to search for available home listings. It also connects unique budgets, real-time rates and loan products with a real estate listings search to help prospective home buyers better understand how much house they can afford. With that being said SunTrust Mortgage Rates were very upfront with closing costs like the loan origination fee. Its most popular programs include fixed-rate mortgages and FHA, VA and USDA loans. Its more specialized loans include a loan program for doctors and dentists, premier loans for high-income earners in expensive neighborhoods and affordable financing for low-income buyers. SunTrust has several mortgage loan options for low- and moderate-income home buyers.

The down payment requirement on affordable SunTrust mortgages is between 0% and 5%, depending on the home loan type. Best of all, some of those programs come with reduced private mortgage insurance requirements. After submitting mortgage applications, make sure you receive a Loan Estimate from each bank. Even if you find a good deal, you can use this document to further negotiate. Send the best Loan Estimate to another lender, and ask them to give you a better interest rate or closing costs — or both. Lenders may be willing to compete for your business, especially if you have good credit.

Rate-and-term refinance allows homeowners to change their loan terms, interest rate, or both. This can help you save money on your monthly mortgage payments, get rid of private mortgage insurance, or accelerate your payoff timeline. SunTrust and BB&T are still merging under the Truist brand, so you can look at either website to find information — including rate quotes. Both websites are easy to navigate and offer several tools and resources to help borrowers through the mortgage process. You'll find calculators, blog posts, videos, and detailed explanations of each mortgage program. You can also call, email, or visit a branch to ask questions, get preapproved, or start a loan application.

If you've built enough equity in your home, consider a HELOC through SunTrust, they are revered for their broad array of home equity loan options. And, as a borrower, if you've been with the bank for three years or longer, you won't have to pay closing costs. Through SunTrust mortgage, a customer can choose a fixed rate mortgage that can span as little as 10 to as many as 40 years in length.